Education & Taxes

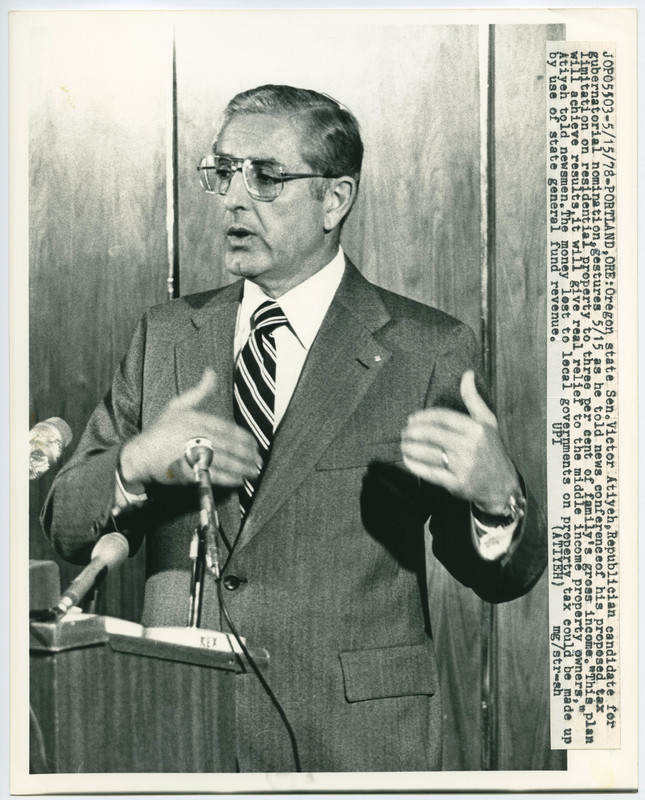

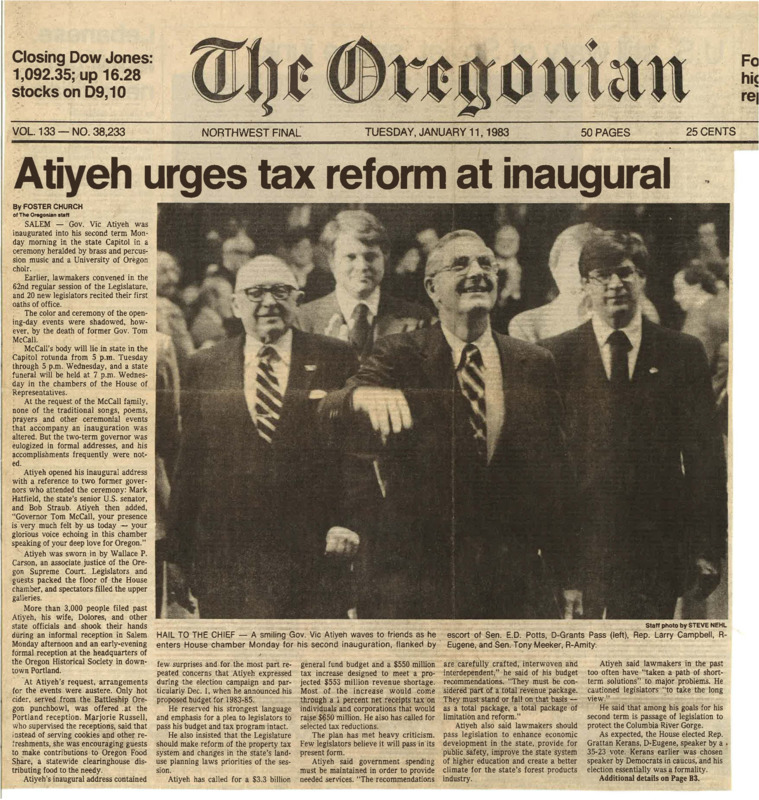

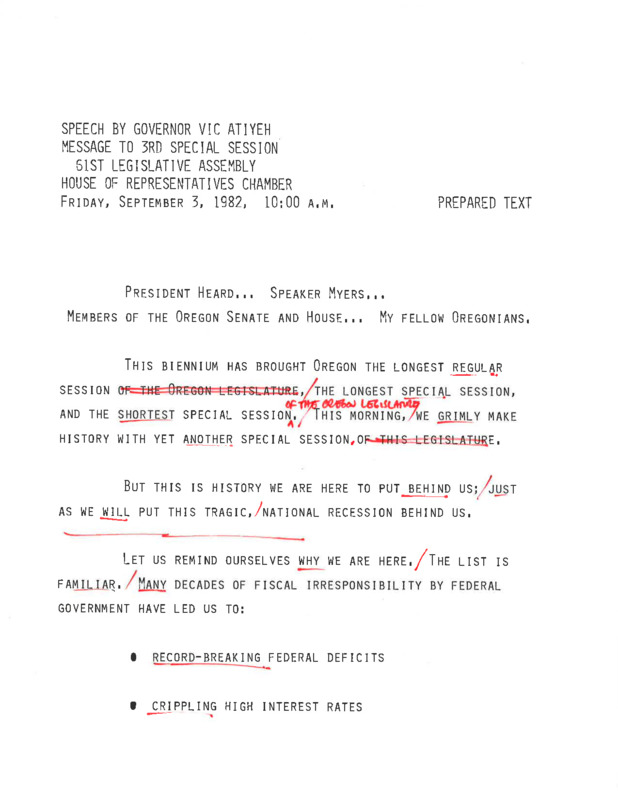

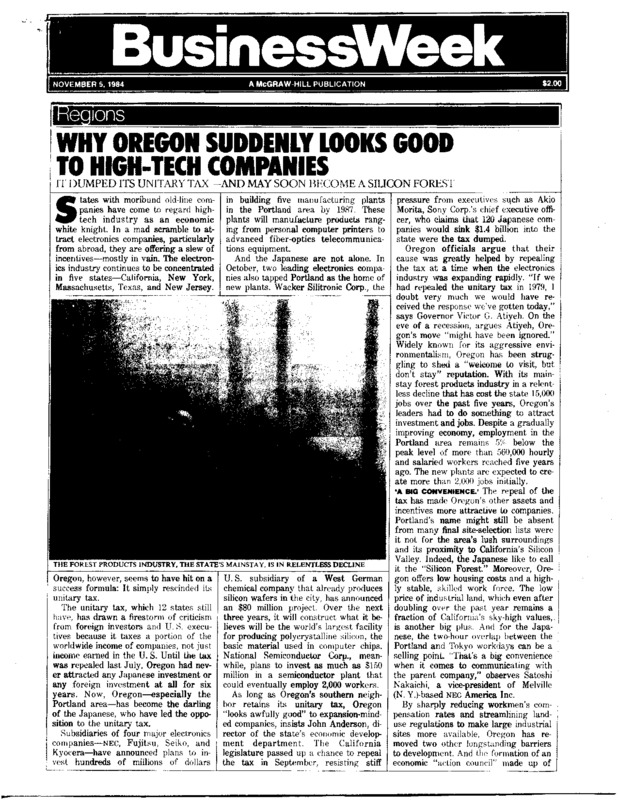

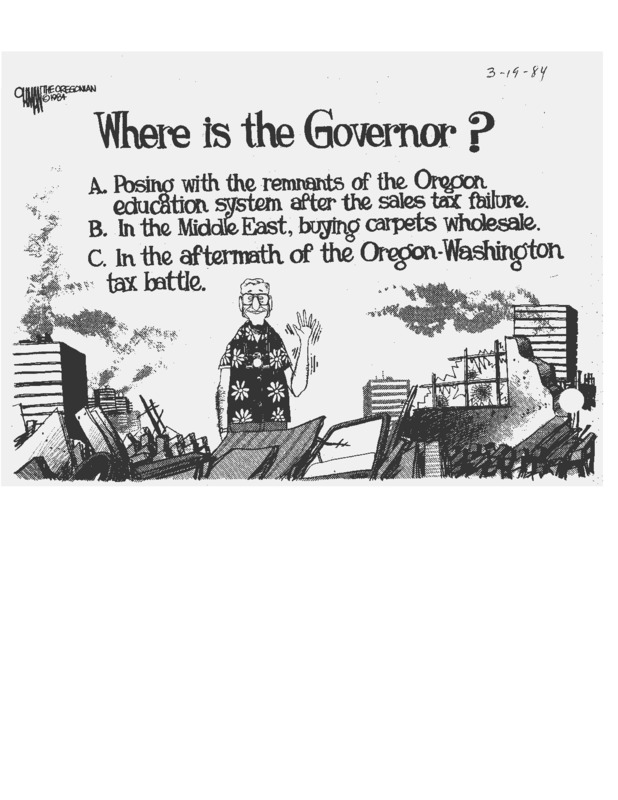

Vic Atiyeh became the governor of Oregon just as the nation began turning its political focus towards lowering taxes and cutting government waste. While Atiyeh supported these efforts, he believed in a balanced approach that would preserve adequate revenue for critical services. He cut expenses and helped to get rid of the Unitary Tax, which targeted corporate earnings. (See sources relating to the Unitary Tax here.) However, when the Recession of 1982 hit Oregon hard and decreased revenues, he was pragmatic: he put his support behind creating a sales tax for the first time in the state. This latter project, called the "Balanced Tax Plan," did not succeed, and Oregon continues to be one of only a few states today without a sales tax.

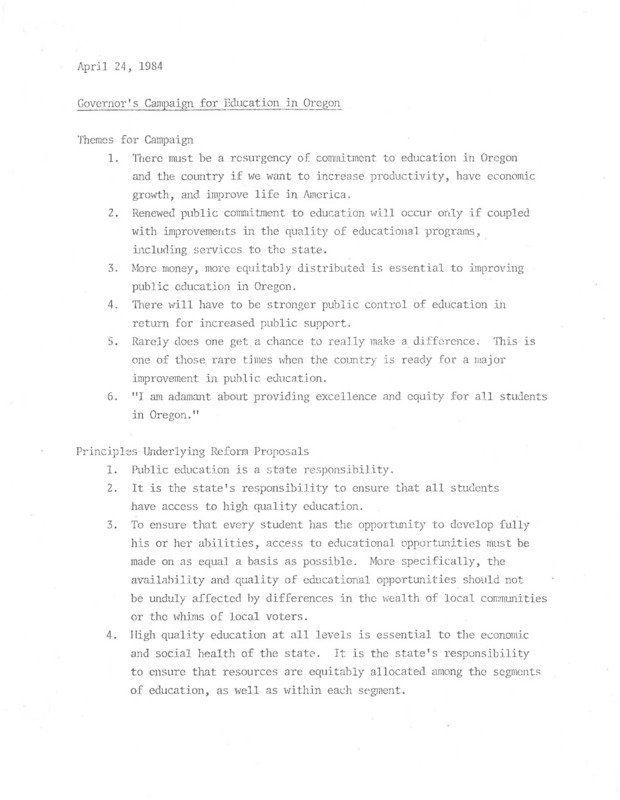

A recurring theme of Atiyeh's budget proposals, and particularly his arguments for a statewide sales tax, was the need for better funding for public education. With the sales tax not successful, the state turned to a controversial use of SAIF (Worker's Compensation) funds to balance the budget. In the end, primary, secondary, and higher education all experienced significant cuts during the 1980s.